As an insurer, we understand that improving road safety goes hand-in-hand with reducing incidents, and therefore lowering claim frequencies and potential losses. We’re also passionate about exploring new technology and its potential to help enhance customer service.

This case study explores how we've helped our fleet customers to become more resilient. We share how the team identify risks and prevent claims.

How it all began

Pre-2021, we’d been working with our customers using standard fleet CCTV technology for more than a decade. Standard technologies had shown minimal improvement to driver safety risks which led to higher frequencies of claims.

The challenge

Between 2021 and 2022, one of our Heavy Goods Vehicle (HGV) fleet clients wanted to protect its loss ratio from the previous year, amidst the challenges posed by global supply and claims inflation.

Claims costs and settlement times had also significantly increased. Up until this point, claims had been settled within 6 weeks but were now taking up to 6 months or longer. This delay meant having vehicles off the road or impounded, with drivers unable to work – leading to substantial operational losses for the fleet.

The solution

To address these issues, we partnered with Lytx®, a global leader of intelligent dash cam technology, to implement a trial solution with the view of FNOR (first notification of risk). Addressing the risk in the first instance should prevent the opportunity to experience a loss.

The Lytx® fleet dash camera is an AI cloud-connected system that continuously uploads video. It offers a 360-degree view with high-quality video and night vision, so you can see what really happened.

The technology monitors key signals of distraction:

- Mobile phone use

- Eating and drinking

- Smoking

- General distraction

- Seatbelt use

If the camera detects any of these distraction factors, it sounds a audio beep into the driver’s cab, with a view that the driver is alerted to the risk and re-focuses on driving.

More on how the dashcam technology works:

Video content cookie policy

As you have previously rejected marketing cookies across RSA's site, this video is unable to play. If you wish to view this video, please allow marketing cookies.

The study and outcomes

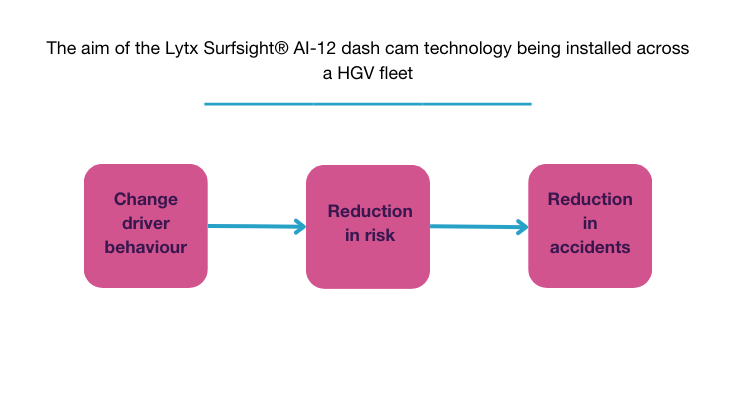

We put together a 12-month trial study where a HGV fleet installed the Lytx Surfsight® AI-12 dash cams.

The results of the study were highly successful, with claims reducing by 21% in the year after having the dash cam technology installed. Clearly, driver safety risks had been addressed in the first instance, reducing accidents, which in turn reduced claims and losses.

Pre Lytx | Post Lytx | |

|---|---|---|

Claims frequency | 29% | 8% |

Loss ratio | 48% | 15% |

Average claims cost per vehicle year | £1713 | £423 |

RSA claims data: pre-Lytx November 2020-November 2021, and post-Lytx November 2021-November 2022.

Hear what our colleagues have to say

What next?

We continue to partner with Lytx and are rolling out the dash cam technology to other fleet clients. Clients with a poor driver safety performance and higher risk levels will be a focus. The data and intelligence to the AI technology is constantly under review by Lytx, with improvements regularly being made.