Small Businesses

e-trade with speed, ease and expertise.

For small businesses - which form the backbone of our economy - efficiency and quality are paramount when it comes to managing their insurance needs.

That's why with RSA, you can expect a swift, seamless, self-service journey from risk capture to renewal.

Defaqto rate 9 of our main e-trade products as 5 Star. Offering peace of mind with flexible, comprehensive e-trade products, in the face of unforeseen events, allowing your small business customers to focus on what matters most: thriving and growing.

A stellar range of commercial cover

Transparent, unbiased assessments help you make informed product recommendations faster.

The independent experts at Defaqto rate 9 of our main e-trade products the coveted 5 Star rating.

It's your trusted shorthand for comprehensive cover, so you can be reassured that you're steering your customers towards a product, independently assessed for quality.

Explore our e-trade products

Business Combined

Commercial insurance for a wide range of SMEs, including cover for liability, business interruption, buildings and stock.

Properties

Cover for commercial and residential property owners which generate a rental income. It’s suitable for portfolios of up to 20 properties.

Offices (incorporating Health & Medical)

Including cover for accountants, solicitors, doctors and dentist surgeries, and veterinary clinics.

Shops (incorporating Hair & Beauty)

Cover for buildings, contents and stock of up to £2.5m. Covers hair and beauty cafes and coffee shops, stores, grocers and takeaways.

Tradespeople and Homeworkers

Products include public and product liability, legal defence costs, tools and equipment.

Pubs, Restaurants and Hotels

For hotels and inns with up to 20 rooms, restaurants, and wine bars with up to 4 premises.

Management Protection

Flexible cover to protect directors and officers against personal liability, for non-profits and private limited companies with up to £100 million turnover.

Professional Indemnity combined

PI insurance to protect businesses that provide advice and services, including accountants, consultants, media and IT professionals, engineers and surveyors.

Cargo eSolutions

Marine cargo insurance for UK-based businesses, with annual or single transit cover for import, export and transit in the UK.

Haulage eSolutions

Liabilities cover for haulage companies and couriers with up to 10 vehicles. Can include cover for UK and EU, loss or damage to goods, and temp-controlled cargo.

Transit eSolutions

Transit insurance for small businesses and tradespeople in the UK, including cover for materials, tools and equipment.

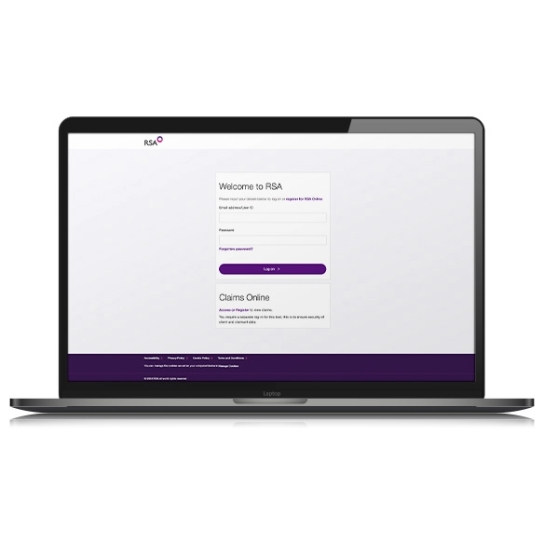

RSA Online puts the efficiency into e-trading

While all of our small business packaged products are available through multiple platforms, there are more great reasons than ever to trade via RSA Online.

We've enhanced usability, giving you an easy to navigate, straight-through experience with fewer questions to answer.

From trade to flood risk, you can check your customer's eligibility before you input their full details, saving you time and trouble.

Your new personalised dashboard displays your priority tasks at a glance - from upcoming renewals and in-progress referrals, to a second chance to win with re-targeted quotes.

It's all designed to help you capture more business, more easily.

e-trading with RSA

Our services are focused on speed, ease and expertise.

Connect to our specialist underwriters in a flash. Choose your preferred method: phone, email or Live Chat. We've put more underwriters at your service - aligned to product-focused teams and empowered with greater authority.

That means you can typically expect an instant online decision on 9 out of 10 cases*. Of the minority that refer, we aim to resolve 90% on first contact**.

And, to keep thing simple, you can find all our contacts in one place. Each of our e-traded products has a single dedicated email, direct to its product-focused team. Or, there's now just one number to call:

(+44) 0345 878 0071

*RSA data January - December 2023

**RSA data September 2023 - January 2024

A confidence inspiring claims service

Our value truly comes to light when a claim is made, and brokers rate our claims service as number 1*.

From first notification to prompt and fair settlement, we aim to respond to new claim emails within 3 hours, helping businesses get back on track sooner. Our specialist handlers can expedite low-value property claims (up to £5,000) for express settlement.

We have our own in-house loss adjusters, to offer fast, efficient and impartial advice. You'll also get quick access to our underwriters to agree the best course of action for each property claim.

*RSA Broker Voice Survey 2023.